BlackRock: The Most Powerful Company in the World?

The Origins

They say “the darkest hour is just before the dawn”. Similar was the case with this man, who had just lost a sum of $100 million but then would soon go on to own a company that holds a sum total $9 Trillion in assets. BlackRock – founded in 1988 by Larry Fink along with Robert Capito, Susan Wagner, Barbara Novik, Ben Golub, Hugh Frater, Ralph Schlosting and Keith Anderson. The idea to form this company came when Fink had lost $100 while acting as the head of First Boston. This experience was what led to the creation of BlackRock with an aim to provide corporations with asset management services to help them manage their risks and investments. The company first got it’s funding from Pete Peterson, co-founder of Blackstone who believed in Fink’s vision of a firm solely devoted to management of risks and such. This led to BlackRock basically turning into an arm of Blackstone and hence was called Blackstone Financial Management. A year later in 1989, after a series of profitable business streaks, Blackstone’s stake in the company fell to 40% as opposed to Fink and his group holding a whopping 60% after the group’s assets had quadrupled to $2.7 Billion. In 1992, the firm was officially named as BlackRock, the name that rules over the world of finance today. By the end of 1992 the company was managing $17 Billion worth of assets which further grew and by the end of 1994 turned into a whopping $53 Billion. Earlier that same year Fink had also become the Chairman and CEO of BlackRock Inc. The company later went public in 1999 at just $14 a share on the New York stock exchange and by the end of that year, the company was worth $165 Billion. The company grew both organically and through acquisitions, with their most significant acquisition at that time being from MetLife. They bought State Street Research and Management Company and SSR Realty Advisors Inc. for $375 million in cash and $50 million of BlackRock Class A common stock. The firm was already hitting media headlines and news outlets and this was just the beginning for BlackRock as they’d soon go on to rule the finance world with Fink at its centre.

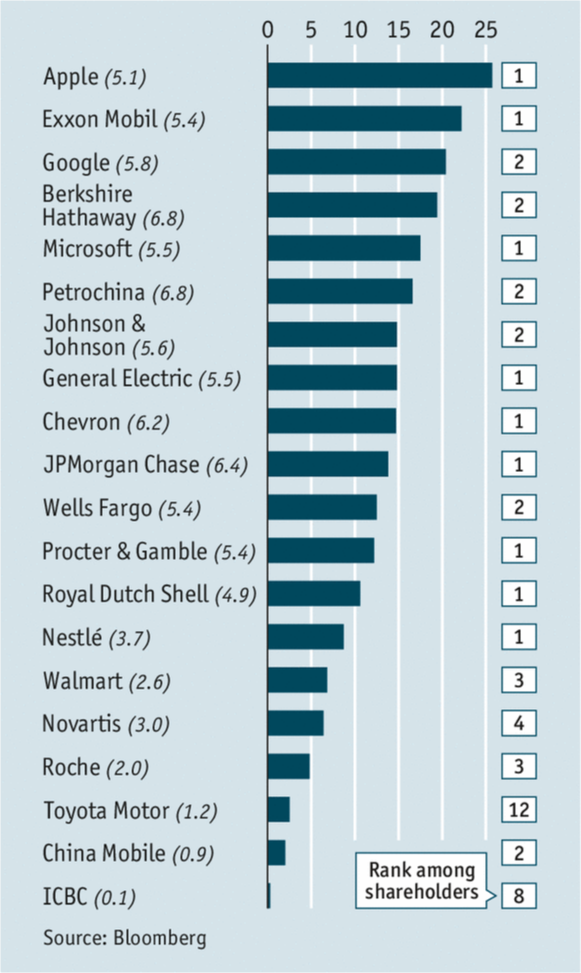

Monopolising the Largest Shareholders Race

The top position holding company in the leader-board on the shareholders race can change and does change based on shares bought and sold from time to time. However, there are solely two companies that are consistently listed among the top holders – Vanguard Group Inc. and BlackRock Inc. The various enterprises owned or shared by BlackRock include – hotel lodging sites like Booking.com, aircraft manufacture for Boeing and Airbus, steel mines for manufacture requirement, oil refineries for airplane fuels, seed production in the agriculture sector such as Bayer, along with other textile manufacturing plants and clothing company. They also have a stack in solar panel production, drug production and also institutes that fund the study of these drugs. Even malls and shopping complexes to e-commerce sites like Amazon and AliExpress are all partially owned by BlackRock. Even the financial sector isn’t free from it – credit card companies, insurance companies, banks, construction companies, telephone companies, restaurants, makeup brands, personal health care brands are all included in their portfolio. Despite all this, why aren’t they all that known in the public eye? Mainly cause, this is what to decided for themselves as there is power in anonymity. If they wanted, they could very easily be featured in the news outlets on a regular basis as they also own 18% of Fox, 16% of CBS and 13% of Comcast. Tech giants like Google, Facebook, Twitter and even Disney are all in one or the other way a part of BlackRock, who easily owns an astounding 90% of the world’s media. Its pretty clear by now that we don’t know about them because they don’t want us to, but what could be the reason behind it? Can a single corporation with this much power really be trusted?

A New World Ruled by Corporations?

When it comes to being such a corporate giant, of course its not all fun and games. Owning a portion of the world doesn’t come without its share of conflicts. BlackRock in August, 2020 became the first foreign company to be allowed into China’s mainland and be a part of their mutual fund industry which meant they could now invest and own parts of major Chinese companies, even including the ones banned from the US. Their first significant investment after the Chinese partnership was Hiki Vision – a safety and communication company that basically makes facial recognition software that is used by the government. Seeing this along with BlackRock’s ownership over banks, e-commerce stores, social media and various other industries, it becomes evident that the company has a wealth of data on people all over the world and they could do with it whatever they pleased. TikTok’s data harvesting is almost child’s play in comparison to what BlackRock is capable of. As the relationship between BlackRock and China grows, so will China’s influence all over the world with our personal data being in the most vulnerable position of easily falling into the wrong hands.

Conclusion:

In almost every major company one can find BlackRock among the top 10 financial investors. With such a massive reach BlackRock is basically the 4th branch of the US government, easily influencing policies and decision making and even lending money to the Central Bank and Federal Reserve in times of crisis. The most noteworthy mention here being the 2008 financial crisis when Timothy Geithner, the New York Federal Reserve leader had to ask BlackRock for their assistance to help manage the distressed assets Bear Stearns and AIG. Similarly, the fed had to once again rely on BlackRock during the 2020 pandemic to stabilize the bond market during economic turmoil. BlackRock in turn has used the central bank and the fed’s dependence on them to grow to an even greater height. With the trajectory that BlackRock has been on, its clear that their influence will only grow as they acquire more and more of the world to control. This definitely causes a great distress as we are headed into a likely- dystopian world where corporations have more power than the government. Things like voting and freedom of speech become meaningless in the face of investment boards. Only time will tell if there ever will be an escape from this dark future that we are all headed towards.

Dipankar Kalita

Diploma in Electrical EngineeringAssam Engineering Institute